US Commercial Real Estate Crisis Spreads to Europe, Hitting German Banks

Key Takeaways:

- The troubles in the US commercial real estate market are now impacting Europe, raising concerns about wider contagion.

- Germany’s Deutsche Pfandbriefbank saw its bonds fall due to worries about its exposure to the sector.

- The bank increased provisions due to “persistent weakness” in real estate markets and described the situation as the “greatest real estate crisis since the financial crisis.“

- Smaller, property-focused German banks are feeling the pain, but larger institutions are less affected for now.

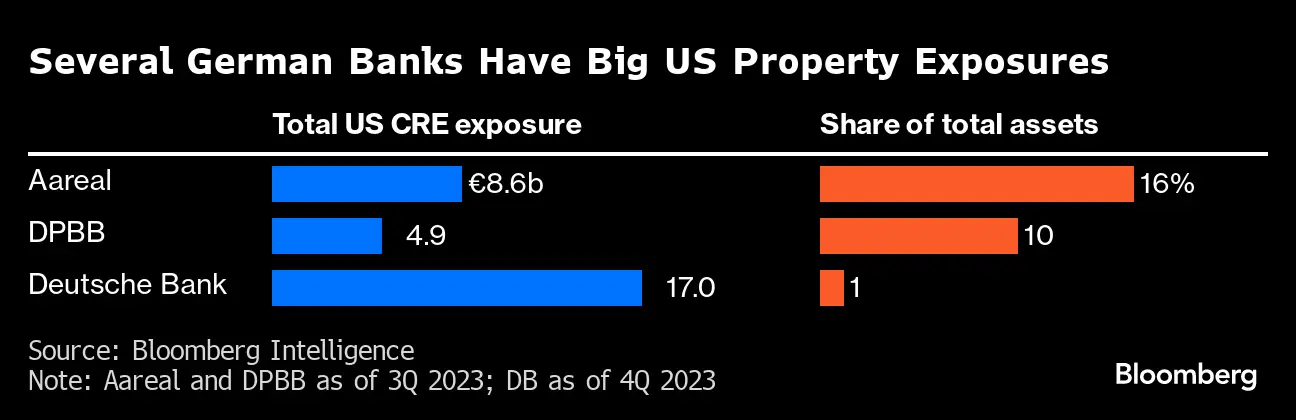

- Concerns are spreading, with other European lenders like Aareal Bank experiencing bond losses due to US CRE exposure.

- Regulators are monitoring the situation, and there are echoes of the 2008 crisis with Landesbanks feeling pressure.

- Analysts predict further write-downs in US CRE, suggesting even more pain to come.

The storm brewing in the US commercial real estate market has crossed the Atlantic, raising alarm bells in Europe. Germany’s Deutsche Pfandbriefbank became the latest casualty, with its bonds plunging on concerns about its significant exposure to the struggling sector. The bank itself warned of the “greatest real estate crisis since the financial crisis,” highlighting the severity of the situation.

Rising interest rates and a sluggish post-pandemic return to work have eroded the value of buildings worldwide, leading to loan defaults and forcing lenders to take hefty provisions. While US office spaces were hit particularly hard, the concerns are now spreading across the pond.

Smaller German banks with a focus on property are feeling the heat, reminiscent of the Landesbanks’ troubles during the 2008 crisis. While larger institutions remain relatively insulated for now, analysts predict further pain ahead, with potential write-downs of up to 15% in US CRE this year.

Regulators are keeping a watchful eye on the unfolding situation, and the echoes of the past recession are chilling. This time, however, the focus is on smaller lenders’ exposure to US commercial real estate, highlighting the interconnectedness of global markets.

Whether this contagion will spiral into a wider crisis remains to be seen, but one thing is clear: the storm is far from over.